How to Protect Your POS System From POS Malware

“Quick Summary” In this digital age, technology is advancing and reaching new heights daily.

In the past, thieves used scanners to extract credit card data. Today, fraudsters directly steal information from magnetic stripe credit cards through point-of-sale malware systems.

Then, hackers may utilize this sensitive and personal information taken from debit and credit cards against the users.

Data leaking will lead to a poor business reputation, immediate legal issues, and unsatisfied customers. Additionally, data theft causes unsuccessful transactions and slower delivery times and creates a perception that the company is risky and unworthy. Due to all this, customers will switch to more secure competitors.

This is when POS security comes to the rescue! To know more about POS malware attacks and their protection, keep reading.

What is POS Malware

It is critical to recognize that all POS systems present some security risks. Many attackers hunt for targets with susceptible systems and conduct automated attacks on their POS systems.

During the payment procedure, the payment card information is encrypted end-to-end and only decrypted in the device's RAM.

Through compromised or inadequately protected systems, POS malware intrudes into POS terminals and searches the RAM for credit & debit card data, which is delivered unencrypted to the attacker.

This process of stealing confidential data through vulnerable POS is known as POS malware.

How Does POS Malware Work

POS system attacks are typically a multi-stage process.

In the initial stage, an attacker frequently acquires access to the intended systems by taking advantage of a system flaw or using social engineering strategies.

When the attacker is inside, they can install the malware, which spreads until it has access to the system's memory and can gather the required data. Afterward, they transfer the data to a different place for consolidation within the target's surroundings before being offloaded to a point outside the system that the attacker can reach.

Then, the malware is installed to steal data from infected systems.

This data comprises the cardholder's name, primary card details, payment modes allowed, and PINs.

Since it is unlikely that the POS system will have access to the outside network, they transmit the stolen data to an internal provisioning server before being transferred from the retailer's system to the attacker.

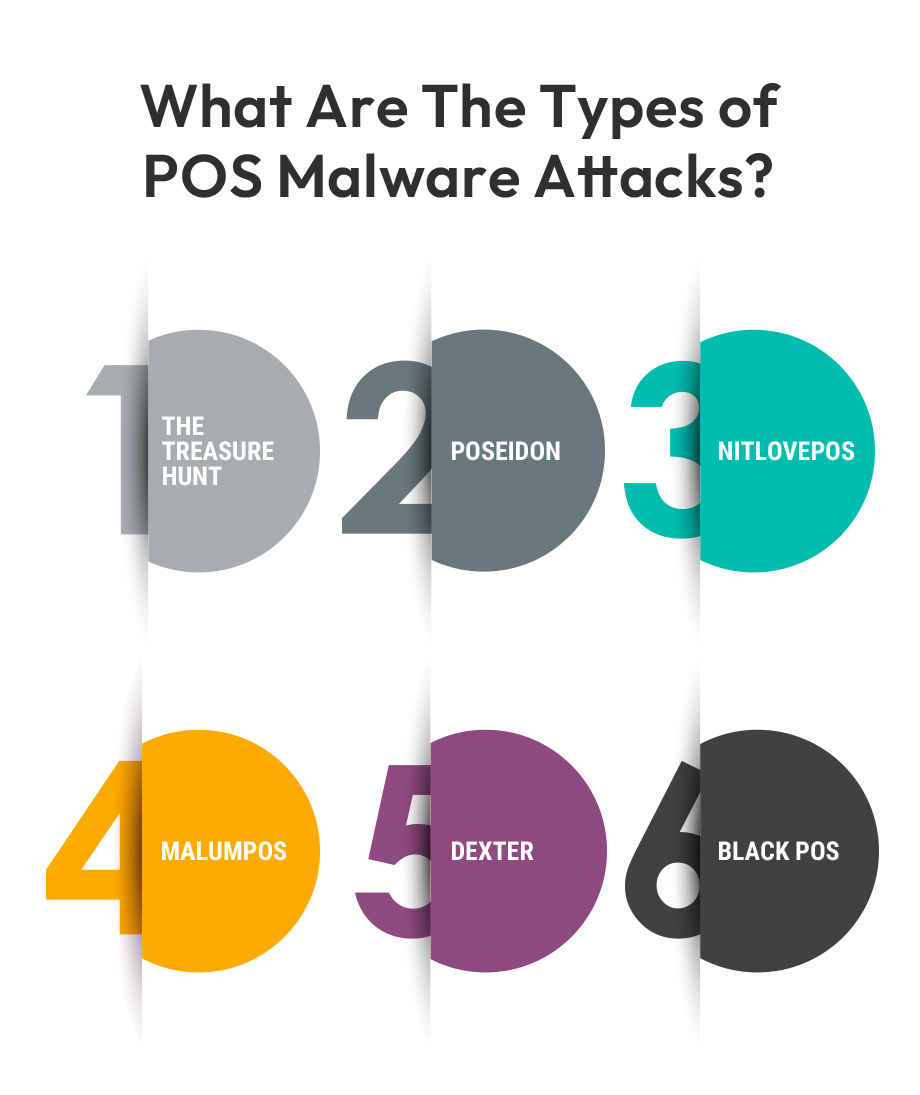

What are the Types of POS Malware Attacks

1. The Treasure Hunt

The treasure hunt was developed solely by a group of attackers who sold stolen credit card information. This type of malware affects retailers who still employ antiquated scrolling mechanisms and installs itself on the device using credentials that have been compromised or stolen. A treasure hunt retrieves the credit card information from the device's storage and sent to the control and command server.

2. Poseidon

Poseidon installs a keylogger on the hacked device and searches its memory for credit card information. Keystrokes are then encrypted and transferred to another site, where they may contain all credit card details and passwords. Even after a user signs off, Poseidon malware can continue to operate in memory and hide by employing clouding tactics.

3. NitlovePOS

NitlovePOS is a type of POS malware attack that scans the operations of infected POS machines to acquire and extract relevant one and two from payment cards. With flawed documents, fraudsters attempt to mislead users. When the victim opens the email, the hackers run a malicious code that allows them to take the data.

4. MalumPOS

MalumPOS is a POS RAM scraper class member, meaning that the malicious software collects client credit card information straight from the infected computer’s RAM. This virus's modular architecture and flexible design make it a scalable threat. To set up different targets, threat actors can modify existing processes or add new ones.

5. Dexter

Dexter is a dangerous POS malware that runs on Windows and has a few active parameters. It analyzes cache contents of transactions using a specific POS program to look for Track 1 and Track 2 data. Cardholders' names and account numbers are included in Track 1 data, while credit card numbers and expiration dates are included in Track 2.

6. Black POS

Black POS is a particular sort of point-of-sale malware created to be placed in POS systems to scrape information from debit and credit cards. It differs from typical memory-scraping malware, which scrapes all the data and requires filters to retrieve the target data.

How Can You Protect Against POS Malware

Point-of-sale security, also known as POS security, steps in to help stop unauthorized individuals from accessing electronic payment systems to steal consumers' private payment information, including credit and debit card numbers.

POS security aims to establish a secure payment gateway where clients can finish their transactions and purchases. It's a must-have requirement for all firms to build consumer trust in the modern world.

The most crucial factors to consider when selecting the best point-of-sale security solution are PCI DSS, EMV, tokenization, cryptography, employee knowledge, and training.

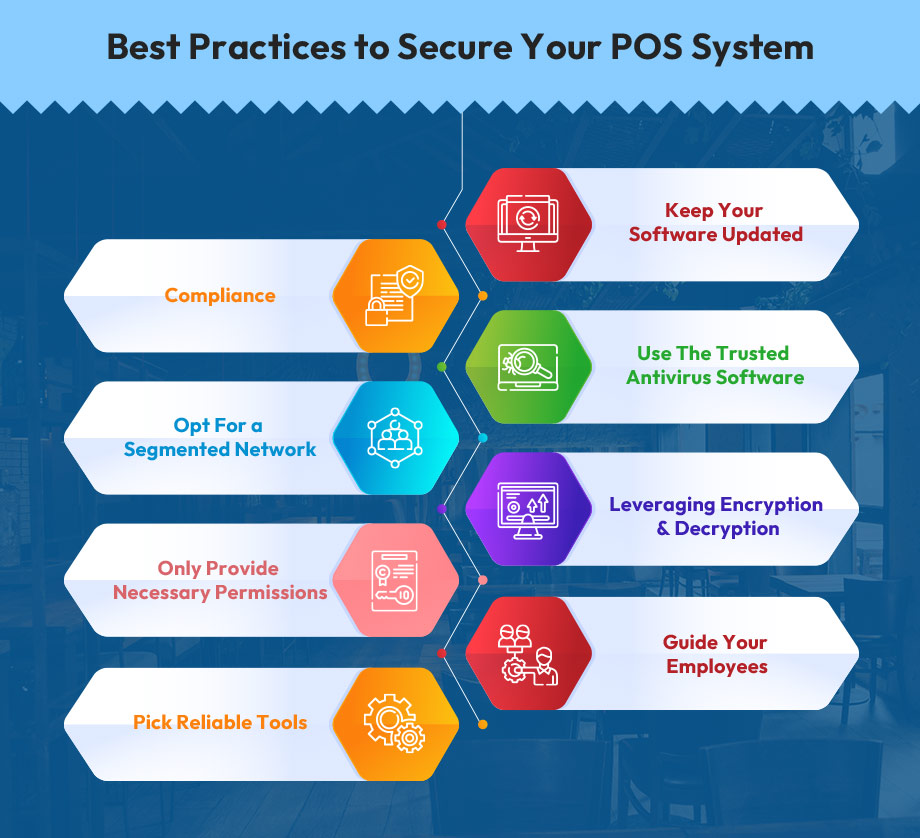

8 Best Practices to Secure Your POS System

1. Keep Your Software Updated

Ensure that the program is updated with the most recent security fixes. Software and components of all kinds frequently receive updates, which could include new features and fixes for any flaws that hackers could take advantage of. Therefore, it is typically advised to keep your software updated to protect your client's data.

2. Compliance

Payment Card Industry Data Security Standard (PCI DSS) is a collection of security measures that provide better and more reliable security. PCI DSS compliance is required for any company that manages and performs online transactions.

3. Use the Trusted Antivirus Software

For additional security, deploy antivirus to secure against POS malware and all other devices linked to the network. Antivirus software constantly analyzes your system and finds any potentially hazardous files or applications to protect it further.

4. Opt For a Segmented Network

Customers at a physical store benefit from an external network because they get free Wi-Fi, and you probably gather valuable data. But there is a risk associated with this. To prevent hackers from quickly exploiting a system and gaining access to financial information through such a network, ensure your network is segmented. Limiting internal network usage to business-related web use and payment systems is advised.

5. Leveraging Encryption & Decryption

Autoionization processes sensitive information and changes into tokens, which are collections of random characters. Even if hackers try to hack, these tokens have no significant value. Encryption processes and transforms the information into a code to prevent unwanted access.

6. Only Provide Necessary Permissions

Managers require access to the POS system's back end, but you must only grant them the necessary permissions. You should allow limited user permissions for the organization's rest of the employees.

To track security breaches and the locations where they happened, keep a record of who has permission and what level of access they have.

7. Guide Your Employees

Consider physical security when designing your POS system. When customers scan their cards to make purchases, cybercriminals may try to attach card skimmers to a POS system to acquire their credit card details. Having a trained and vigilant staff increases security, helping avoid such behaviors.

8. Pick Reliable Tools

Consideration, investigation, and additional discussion with your service providers are necessary when selecting the best tool for the job. It may sound incredible to use freeware or a cheap tool included with another piece of software, but doing so carries a risk and will ultimately cost you more money. Therefore, spending money on specific, reliable, and safe tools for your business operations is advised.

Conclusion

Here's a complete wrap-up about POS system malware and some of the best practices you can use to secure your POS system from POS malware further. Over time, we have understood that it is more critical than ever for organizations to have comprehensive security policies in place, especially regarding point-of-sale malware.

So, if you are looking forward to securing your POS system, try out our full-fledged POS security software - OVVI. To know more, get a free demo now